Indian companies are increasingly becoming mature in analytics and embedding data-based insights for decision making

Digital transformation is fueling a data revolution and providing businesses an opportunity to use data to achieve different objectives such as improve customer experience, identify new business opportunities, enhance products and services, better manage business operations, maintain infrastructure and much more. According to World Economic Forum by 2020 the world had generated approximately 44 zetabytes of data.

Analytics is aiding decision making and shaping business outcomes in all fields and across functions. Digital penetration in our day to day lives is providing insights to business as we are continuously engaged with the world via some digital media be it browsing messages on the phone, social media, email, searching online for something, etc. These activities leave a digital footprint which can be harnessed to gain greater understanding and insights into human behaviour and when these insights are combined with contextual data such as the broader market trends, external influencing factors, businesses can get actionable insights.

The State of AI in 2021, a global survey across industries and company sizes, conducted by McKinsey Global Institute between May and June of 2021 finds that Indian companies demonstrated the highest adoption of AI amongst all regions in the world. Broadly, emerging economies such as China, Middle-East and North Africa and that AI adoption has shown a steady increase over the past year.

The data engineering market is pegged at USD18.2 billion in 2022 and it is estimated to grow at a CAGR of 36.7% in the next five years to reach USD86.9 billion by 2027, according to AIM. Banking and insurance industries are ahead of other sectors in terms of employing the highest share of data engineers at 37.7% according to the same report and most of the engineers are working in Python.

Digital native companies such as fintech, edtech and ecommerce are also using advanced analytics in a number of use cases from fraud detection, infrastructure performance to managing logistics, operations and supply chain.

Indian Businesses Use Analytics for Differentiation

Many businesses in India are embracing digital transformation to tap the information, data and assets trapped in siloed and legacy environments. This is helping organizations to embark on game-changing strategies where decision making based on informed insights and products and services are enhanced with continuous improvements.

One of the main application areas Indian companies are using analytics is to create customer experiences. For example, Vistara Airlines is using AI and analytics to elevate the customer experience and create a differentiation. Analytics is enabling the company to create differentiated treatment for preferred customers like Club Vistara members and during the pandemic the airlines strived to use analytics and AI to deliver touchless services. Analytics forms a key plank of Vistara’s brand building strategy to understand customer preferences.

Analytics is also enabling companies to create disruptive business models. Given that most fintech are targeting marginalized sections, technology is a key lever to extend reach, assess risk and build prediction models to extend financial inclusion for emerging India. At the same time fintechs are driving financial wellness through enabling access to personalized and affordable digital products like micro loans and micro insurance and providing personalized finance management tools by leveraging data driven models and advanced AI/ML innovations.

Fintechs such as SmartCoin, MyMoneyMantra and Spice Money are heavily invested in analytics to sustain the business. These new age companies are using big data to predict customer behaviour, design complex risk assessment models to assess the credit worthiness of customers, spot and resolve customer issues proactively to create a service niche and differentiation compared to traditional banks.

Noida-based fintech Spice Money offers a disruptive model using analytics. One of India’s leading rural fintech platform empowering rural nanopreneurs, also known as Spice Money Adhikaris, it caters to rural banking and financial needs offering multiple products. Spice Money’s phygital model combines on-ground rural nanopreneurs through an assisted digital business model.

Built on a model of trust where the local Adhikari is a Spice partner, the Spice Money platform enables a rural kirana store or an entrepreneur to start operating as a mini bank branch and provide banking and digital services to consumers in semi-urban and rural India.

The company then leverages analytics to design customized products to suit the needs of the local population. A lot of data is generated all the time and Spice Money is using that information to better understand customer needs to design new products.

The need to provide new customer experiences is driving the adoption of analytics in most sectors and specifically in the retail segment. Customer preference for an omnichannel experience has seen a noticeable increase since the pandemic wherein people may browse online and shop at the physical store, or buy online and pick up in-store.

Retailers are working hard to know individual customers and innovatively proposition each customer via a personalized approach. “We do a lot of marketing campaigns, and we are leveraging analytics to see the ROI. We analyse customer segmentation, customer response behaviour, for online as well as offline stores. This enables customised campaigns, resulting in higher impact,” says Dinesh Joshi, CIO of Good Earth.

Analytics has enabled Good Earth to design a highly effective loyalty program by continuously monitoring customer behaviour and browsing habits to create a seamless experience across channels and touch points.

One of the outcomes of observing customer journeys was to enhance the mobile experience with progressive web app as 90% traffic emanates from mobile with 70% checkouts. Speaking about the efforts to enhance the customer journey, Dinesh Joshi, CIO of Good Earth says, “Digital is deeply integrated into our business strategy as it enables us to study the customer experience at every touchpoint with data capture. This provides insights to personalize subsequent engagements, provide better recommendations and enhance search capabilities.”

Increasingly Indian businesses are investing more in analytics and deep learning technologies to make real business decisions. By harnessing more hard data, identifying new sources of data and consolidating all data sources to get a unified view on trends and have more inferences along with live dashboards Indian companies are sharpening decision making with date-based insights.

Building a Robust Analytics Foundation

However, even though businesses want to use data for decision making it is still challenging. Digitization efforts are not still complete and still there are many pockets within the organization where things are done manually and it is a challenge to harness that data for data driven decisions.

“The phrase does sound unusual, Garbage in, Garbage out (GIGO) but its meaning is quite straightforward. If the process itself is not well developed, then naturally the output will be flawed. Similarly, when initiatives like Enterprise Architecture, Data Lineage and Process Engineering are not implemented well in the organization, then analytics and AI initiatives will not yield the desired benefits.” Says Manuj Desai, Global CIO, STL.

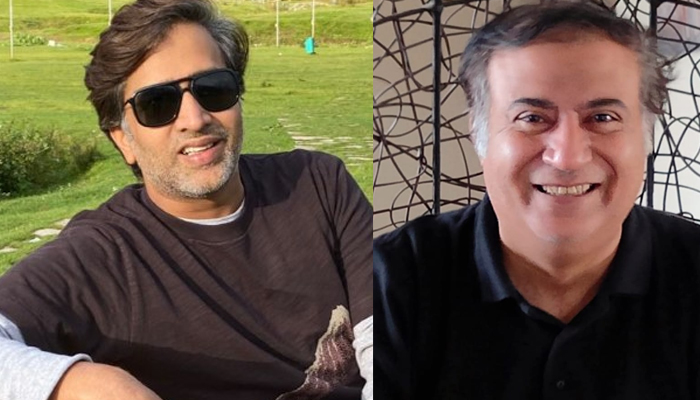

Manuj explains that organizations often have gaps in the data lineage or lack an architectural perspective and the best way to assess the maturity of the digital landscape is to ask simple business-related queries and if the environment can provide the answer, systems are in good shape. He emphasizes that CIOs need to have a five-year outlook on the digital strategy underlined by the GIGO perspective. The digital journey according to Manuj can be broken into four steps: descriptive, inquisitive, predictive and prescriptive and each stage can be measured and streamlined by asking questions.

“The phrase does sound unusual, Garbage in, Garbage out (GIGO) but its meaning is quite straightforward. If the process itself is not well developed, then naturally the output will be flawed. Similarly, when initiatives like Enterprise Architecture, Data Lineage and Process Engineering are not implemented well in the organization, then analytics and AI initiatives will not yield the desired benefits.”

Manuj Desai, Global CIO, STL

Even when the digital strategy is in place, challenges related to data quality persist and so it is important to do a root cause analysis and rectify issues related to data quality. Quality of data is similar to the issue of technical debt in software coding. Once poor-quality data creeps in, it amplifies into poor decision making at multiple levels and so it is important to do a root cause analysis and identify the cause. It could be a gap related to process or service definition, whatever the cause must be sorted to ensure data sanity.

Another challenge that creeps in once users find data inconsistencies is that people do not trust the data and the entire strategy of having a single version of truth falls flat.

Governance is key to have a robust data foundation to ensure version control, adherence to compliance and data security. Along with governance, robust access control with layered access to who has access to what kind of data based on identity and roles are important capabilities in the data architecture of the organization.

Towards Analytics-enabled Future

Analytics-enabled businesses are extracting competitive advantage with meaningful and actionable insights from data. Early adopters are breaking boundaries by eliminating systemic inefficiencies and ushering in higher accuracies in data and translating that into business decisions. This is helping them to create an impact with better customer engagement strategies and disruptive business ideas, and setting the stage to embed analytics as the bedrock of business strategy to flourish in an age of digital transformation.

“We do a lot of marketing campaigns, and we are leveraging analytics to see the ROI. We analyse customer segmentation, customer response behaviour, for online as well as offline stores. This enables customised campaigns, resulting in higher impact.”

Dinesh Joshi, CIO of Good Earth