Fujitsu has reached an agreement with Mizuho Financial Group, Inc., Sumitomo Mitsui Financial Group, Inc., and Mitsubishi UFJ Financial Group, Inc. to conduct a joint field trial of a person-to-person money transfer service using blockchain technology. The trial will begin in January 2018 and last for about three months. Fujitsu has already initiated development of the trial system.

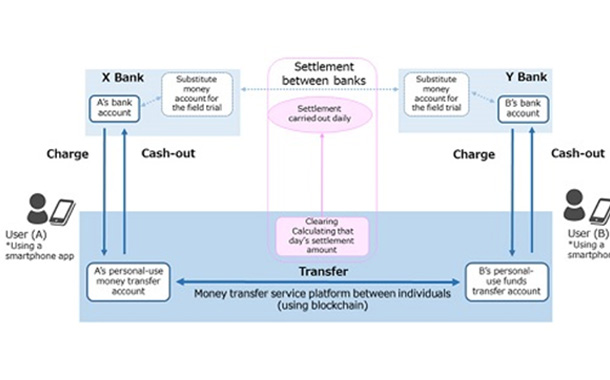

For this field trial, Fujitsu will develop a cloud-based blockchain platform for money transfers between individuals that can be jointly used by these three major banks, as well as a smartphone application that allows users to easily handle the different steps for sending money and for making deposits and withdrawals. Fujitsu and the three major banks will verify that this system can seamlessly link a money transfer account for individuals set up on this platform with the user’s actual bank account. The field trial will additionally confirm whether the new platform can accurately and securely handle a series of processes, including transferring value between money transfer accounts for individuals, as well as clearing and settlement.

Through this field trial, Fujitsu will work to develop a service platform that is highly convenient for users in an increasingly monetarily diverse, cashless society.

Background

There is a growing wave of digitalization with improvements in the performance of computers and innovations in such related technologies as AI and blockchain. In the financial industry as well, Fintech is representative of many emerging new services using cutting-edge technology. Against this backdrop, Fujitsu will commence field trials with three major Japanese banks that possess broad customer bases to evaluate the creation of new services in the field of person-to-person money transfers.

Overview of the Field Trial

- Trial Period

– Building the trial system: September-December 2017

– Field trial: January-March 2018 (planned)

- Goal

Verify the technology and functionality necessary for money transfer services between individual account holders at banks using blockchain technology.

- Trial system under development

– Money transfer service platform between individuals utilizing blockchain technology

– Smartphone app for users of the service

- Implementation

– Transfer digital value between individuals’ money transfer accounts created on the new money transfer service platform for individuals

– Evaluate the system’s application of the series of processes involved in monetary transfers between individuals, including transferring funds from the money transfer account for individuals and the actual bank account linked with it

- Points to be evaluated

– Seamless linkage between the money transfer account and the actual bank account (debits and credits of funds)

– Practical functionality and operability that improves convenience and provides a more user-friendly authentication user experience when interacting with the service

– Accuracy, safety and practicality in a series of processes, including clearing and settlement

(1) Money transfer account

A pseudo-account created on the money transfer service platform for individuals for each service user.

(2) Clearing

The calculation of the amount to be paid between banks, settling the funds transfers that occurred between money transfer accounts for individuals. In this instance, the process will be handled daily.

(3) Settlement

The payment and receipt between banks of the amount calculated in clearing, completing the transfer.