Written by Omdia’s Cloud and Data Center Research Practice: Vladimir Galabov, Michael Azoff, Roy Illsley and Manoj Sukumaran

The world was abuzz this week as news of Broadcom’s intent to acquire VMware came to light. Broadcom started out as a semiconductor chip company (Avago acquired Broadcom in 2015 and renamed itself Broadcom, with the AVGO stock ticker) but built a software infrastructure portfolio with acquisitions of Brocade (2017), CA Technologies (2018) and Symantec (2019). In interviews Hock Tan talks about identifying strong assets, optimizing execution and costs to reap the returns. Companies, like CA, are mature, with a well-established market and customer base that can be seen as a cash cow for Broadcom. If we look at Broadcom revenue figures from 2017 to 2021, see Table 1, we see the results of this strategy. Of interest here is the growth in infrastructure software revenue.

Table 1: Broadcom reported fiscal year-end figures in $ billions

| 2021 | 2020 | 2019 | 2018 | 2017 | |

| Total net revenue products | 27.5 | 23.9 | 22.6 | 20.8 | 17.6 |

| Net revenue semiconductor solutions | 20.4 | 17.3 | 17.4 | 18.9 | 17.6 |

| Net revenue infrastructure software | 7.1 | 6.6 | 5.2 | 1.9 | – |

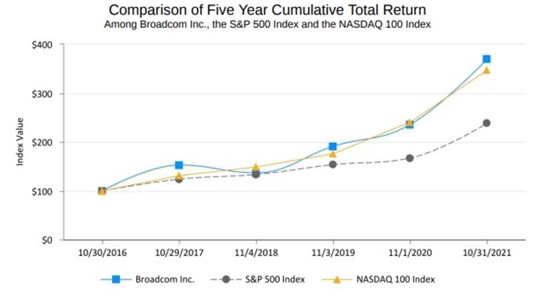

Figure 1 shows how the market has viewed Broadcom over this period, where it has performed in line with the NASDAQ index, reflecting the success of Broadcom’s strategy. It has executed well on building itself into a technology powerhouse, spanning semiconductors and infrastructure software.

VMware – the cash cow

VMware has some similarities with CA. It is the market leader in the well-established virtualization software which is generating a steady revenue stream. It’s also facing a challenge – it was late to the high growth market for container software and microservices, where Red Hat established itself as a leader. VMware is also going through a transition in its revenue streams from upfront license payments to a SaaS model. Both the business model transition and the disruption to the server virtualization market have impacted VMware’s revenue growth, which slowed from double to single digits on an annual basis. However, don’t expect their revenue to suddenly drop off a cliff. Rearchitecting an application environment is difficult and virtualization users will not suddenly switch to an alternative abstraction technology.

Key to VMware’s growth acceleration plan is investing in growing its container software business, formed from the acquisition of Pivotal. Pivotal’s staff, software and services are the main building blocks of VMware’s Tanzu. Because the organisation at VMware enabling Tanzu is comprised of mostly legacy Pivotal colleagues, it has a strong open source and agile/DevOps culture. For example, they are a strong contributor to efforts like Java Spring and Spring Boot. The question is how will Broadcom treat VMware’s container business? It is not key to VMware being a cash cow and will require an investment push to seriously compete with Red Hat. Given how focused on optimizing costs Broadcom’s leadership team is, it makes us concerned that VMware’s container software business would not get the investment needed to grow, or worse, get the chop.

VMware – the final cog in a bigger strategy

If Broadcom are not just acquiring a cash cow but building a vertical stack of components from processor to application, then this move could prove to be highly transformative as it provides them with another key capability in that stack. The question of how effective a full stack strategy is, has been a topic of debate in the industry for a while. IBM with Red Hat have gone the open route. Dell acquired VMware then disposed of it, after presumably deciding the full stack strategy was not working.

In enabling edge computing, a full stack model is highly appealing as many enterprises do not have the resources to create a custom edge solution that works well. Being able to purchase an appliance and just drop the application on it with the confidence that it will work and be compatible with the rest of the enterprise’s environment is appealing. VMware has a large customer base and is a platform in all public clouds as well as on-premises, so in theory it is very well placed. However, the VMware technology as a stack is expensive, when compared to the newer Kubernetes approach. Therefore, the big question is, if Broadcom does have full stack ambitions, how is it going to package and price the stack.

Bottom line – best to not overthink it

The indication that Hock Tan, Broadcom’s CEO, has given in earnings calls is that his strength is optimizing software companies for maximum profitability. This makes us think that the cash cow scenario is more likely. It looks like Broadcom’s goal is (1) acquire companies with established technology and client base which are less exciting to investors and are cheaper, (2) optimize cost, (3) milk them dry over the next 10-15 years. Software can have incredible longevity because of application interdependencies and the uplift to rearchitect an entire environment. The world might be going cloud native but most application still run on (legacy) VMs.