Nearly all (94%) device makers have invested in software development in the past five years; Nine in 10 (88%) believe the Internet of Things (IoT) is driving growth within the manufacturing industry

Surveying 300 business decision makers in device manufacturing firms across five major global markets, Gemalto is embracing software over hardware as its primary business model. The change highlights how crucial software is becoming to device manufacturers, specifically in improving business performance and growing revenue. And, as end-users begin to demand more options and control of their devices and data, entire industries are being forced to change their business models and strategies to cater to their customers.

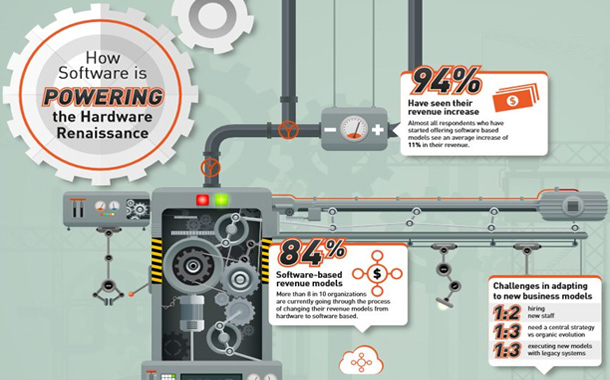

According to Gemalto’s ‘How Software is Powering the Hardware Renaissance’ report, the majority (84%) of organizations in the sector are changing how they operate. In fact, nearly four in 10 (37%) have already made a full shift to a software-centric business model, one that places software at the core of how a company delivers value and generates revenue. The research also found that 94% of respondents have increased their investment in software development in the last five years. Germany is leading the charge. All (100%) of German organizations questioned have boosted their software-based services over this time; with France second (98%) and the US (93%) in third.

Substantial benefits

Hardware technology companies are already reaping substantial benefits – of those that have changed their models, the average increase in revenue has been 11%. They expect further growth in the next five years, with the revenue from software projected to rise from 15% to 18%.

As well as revenue growth, businesses that have moved to software-based selling have seen other benefits. Over eight in 10 have driven diversity in hardware with software features (86%), implemented remote feature upgrades (84%) and improved customer experience (84%). Businesses also report having a more flexible strategy that allows them to adapt to market change (79%), better control copy protection (76%) and being more competitive in the market (73%).

These changes are also having a positive impact for employees. The majority of businesses have retrained their employees (64%) and hired new ones (58%), with three in five (61%) also revealing they have or intend to reshuffle employees into different roles.

Opportunities in IoT

With businesses starting to see the potential of the IoT, software-based business models are generating commercial benefits. Around nine in 10 respondents (88%) believe IoT is driving growth in the industry and that IoT itself is a chance to change their company’s business model (85%). Enabling automated upgrades (61%), remote support (57%), collecting usage analytics (54%) and gathering increased and higher quality customer insights (53%) are the main benefits businesses see IoT enabling.

Challenges of software-based selling models

While it may bring substantial benefits and new opportunities, changing from a hardware to a software-based selling model isn’t without challenges. When it comes to practicalities, almost all organizations (96%) that have changed, or are changing, have experienced some difficulties in making the transition work.

Looking at the challenges faced in more detail, one in two (56%) respondents reported that they needed to hire staff with different skills. Around one in three said solutions evolved organically without a central strategy (36%) and managing new sales and operational methodologies with outdated legacy processes (34%), caused challenges in the transition.

“The results of this survey validate what we see on a daily basis with our customers as we help them make this transition,” said Shlomo Weiss, Senior Vice President, Software Monetization at Gemalto. “Companies who adopt software-based revenue models will reap three main benefits: long term relationships with their customers, predictable revenue streams and a clear competitive advantage. From gaining insight into product usage, to pay-per-use payment structures and on to new market penetration – all the companies we surveyed identified a real need to transform how they do business.”