Results show only two percent of APAC companies are considered truly “intelligent” enterprises that leverage ties between physical and digital worlds for better visibility and actionable insights

Zebra Technologies Corporation revealed the results of its inaugural “Intelligent Enterprise Index”. This global survey analyzes where companies are on the journey to becoming an Intelligent Enterprise; how they are connecting the physical and digital worlds to improve visibility, efficiencies and growth.

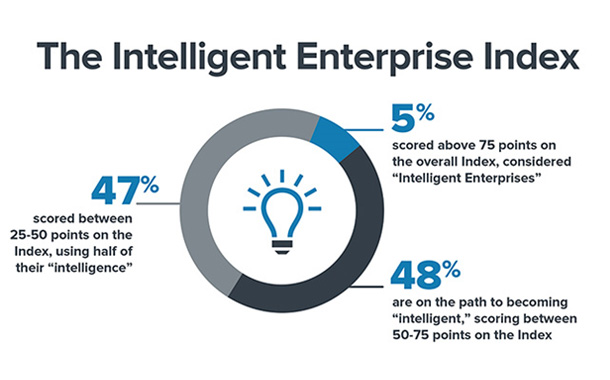

Globally, 45 percent are on the path to becoming intelligent enterprises, scoring between 50-75 points on the overall index. Only eight percent exceeded 75 points on the index. In comparison, Asia Pacific respondents scored above the global average, with 51 percent of those polled scoring between the 50-75 points, but merely two percent were above the 75-point benchmarks that qualify them to be considered an “intelligent” enterprise.

The Intelligent Enterprise Index measures to what extent companies today are meeting the criteria that define today’s Intelligent Enterprise. Some of the criteria include Internet of Things (IoT) vision and adoption plan as well as business engagement in developing a return on investment for IoT. The criteria were identified by leading executives, industry experts and policymakers across different industries at the 2016 Strategic Innovation Symposium: The Intelligent Enterprise, which was hosted by Zebra in collaboration with the Technology and Entrepreneurship Center at Harvard (TECH) last year.

The framework of an Intelligent Enterprise is based on technology solutions that integrate cloud computing, mobility, and the Internet of Things (IoT) to automatically “sense” information from enterprise assets. Operational data from these assets, including status, location, utilization, or preferences, is then “analyzed” to provide actionable insights, which can then be mobilized to the right person at the right time so they can be “acted” upon to drive better, more-timely decisions by users anywhere, at any time.

IoT vision is strong and investment set to increase. In APAC, 38 percent of companies spend more than $1 million toward IoT annually, and 80 percent expect that number to increase in the next one to two years. In fact, 67 percent of APAC companies expect their IoT investment to increase by 11 percent or more during this time. However, 39 percent of companies today have not executed on their IoT plans or do not have any plans at all. Although only 36 percent currently have company-wide deployment, it is expected that 65 percent will have it deployed company-wide in the future.

Customer experience is driving IoT. Seventy-one percent of companies claim the largest driver of IoT investment is improving the customer experience. In the future, increasing revenue (54 percent) and expanding into new markets (53 percent) are expected to be the largest drivers.

Business engagement is top of mind, but culture should be given more consideration. Eighty-one percent of companies have a method in place to measure ROI from their IoT plan, and 73 percent have IoT plans that address both the cultural and process changes necessary to implement it.

Many companies lack an adoption plan. Fifty-four percent of companies expect resistance to adopt their IoT solution, yet don’t have a plan in place to address it. Only 27 percent who expect resistance, have a plan to address it.

Companies keep employees informed, but there is room for more. Approximately 83 percent of companies share information from their IoT solutions with their employees more than once a day, of which half of these employers share in real or near-real time. However, only 34 percent provide actionable information to all employees, and information is provided either via email (69 percent) or as raw data (67 percent).

The online survey was fielded from August 3-23, 2017 across a wide range of segments, including healthcare, manufacturing, retail and transportation and logistics. In total, 908 IT decision makers from nine countries were interviewed, including the U.S., U.K./Great Britain, France, Germany, Mexico, and Brazil. Of these, about a third were from the APAC markets, including China, India, and Australia/New Zealand.

Eleven metrics were used to understand where companies are on the path to becoming an Intelligent Enterprise, including: IoT Vision, Business Engagement, Technology Solution Partner, Adoption Plan, Change Management Plan, Point of use Application, Security & Standards, Lifetime Plan, Architecture/Infrastructure, Data Plan and Intelligent Analysis.

Tom Bianculli, Chief Technology Officer, Zebra said, “An ‘Intelligent Enterprise’ is one that leverages ties between the physical and digital worlds to enhance visibility and mobilize actionable insights that create better customer experiences, drive operational efficiencies or enable new business models. This is a journey for enterprise organizations so we wanted to see where most companies are in the process. Clearly, many are still forming their IoT strategies, but we are seeing segments that have identified targeted use cases and are aggressively deploying solutions.”