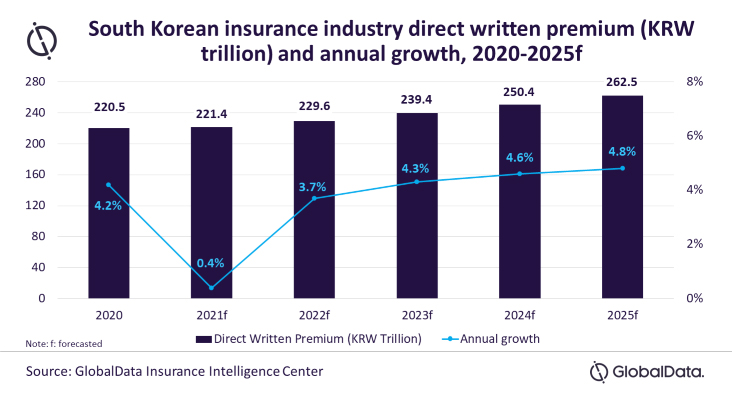

South Korean insurance industry is projected to grow at a compound annual growth rate (CAGR) of 3.5% from KRW220.5 trillion ($186.8bn) in 2020 to KRW262.5 trillion ($229.5bn) in 2025, in terms of direct written premiums, forecasts GlobalData, a leading data, and analytics company.

Anjuli Srivastav, Insurance Analyst at GlobalData, comments: “After growing by 4.2% in 2020, the industry is expected to contract by 0.4% in 2021. The decline is mainly driven by life insurance segment, which is expected to contract by 2.5% due to the persistent low-interest-rate environment, reduced disposable income due to the COVID-19 pandemic, and an aging population.’’

Life insurance accounted for 54.0% of the industry’s direct written premiums (DWP) in 2020. The segment is expected to revive in 2022 and grow by 1.9%, driven by post-pandemic economic recovery and increased awareness, which will boost the demand for health insurance products.

Srivastav continues: “Maintaining strict solvency and capital requirements for annuity insurance products under the upcoming IFRS-17 and K-ICS regulations will prompt insurers to shift their focus towards protection-type products over the next few years. As a result, life insurance is expected to grow at a CAGR of 1.6% during 2020-2025.”

General insurance segment accounted for the remaining 46.0% of the DWP in 2020. The segment grew by 7.0% in 2020, driven by an increase in motor premiums and improved underwriting performance of general insurers. However, it is expected to witness a slower growth of 3.8% in 2021 due to the economic impact of the pandemic.

South Korean insurers’ have also taken initiatives to divest from high-risk non-renewable energy projects and invest only in renewable energy projects, which is expected to support their underwriting performance in the coming years.

In June 2021, insurers like Hyundai Marine & Fire Insurance, Hana Insurance, DB Insurance, and Hanwha General Insurance pledged to stop providing construction and operational insurance coverage to any new coal projects.

Srivastav concludes: “The outlook for the South Korean insurance industry looks positive driven by economic recovery, increased investments by insurers in digital transformation, ESG related initiatives, and positive regulatory environment.”

Read More News: https://www.enterpriseitworld.com/

Watch CIOs Tech Perspectives: https://ciotv.live/

Read IT Partner News on: https://www.smechannels.com/