World Payments Report 2018: Developing markets are driving rapid growth in non-cash transactions but banks are facing multiple barriers to the creation of a new ecosystem for payments as regulatory and operational complexities to innovation remain

Digital payments are experiencing a boom, driven by developing markets, according to the World Payments Report 2018 launched today from Capgemini and BNP Paribas. However, the innovation landscape in payments is uncertain as BigTech entrants make their presence felt, and incumbents face technical and regulatory complexity in the development of new collaborative payments ecosystems between themselves and FinTechs. The report finds that it will take more than bank-led initiatives to grow the new payments landscape. The broader financial services community – including public-sector organizations, regulators and third parties – must determine their new roles and work together with large payment users to ensure a smooth, balanced, and robust payments ecosystem development.

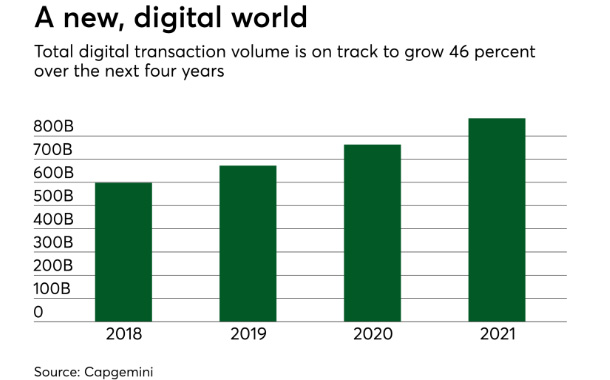

Developing markets are driving non-cash growth: The report forecasts that non-cash transactions will post a compound annual growth rate (CAGR) of 12.7 percent through to 2021, following growth of 10.1 percent in 2015-16, which saw the total volume of non-cash transactions reach 482.6billion.

This non-cash boom is being driven by developing markets, with Russia (CAGR of 36.5 percent), India (33.2 percent) and China (25.8 percent) as notable movers during 2015-16. Mature markets maintained steady growth of more than 7 percent.

Developing markets are set to show a 21.6 percent CAGR, led by emerging Asia at 28.8 percent over the next five years. By 2021, developing markets are expected to account for around half of all non-cash transactions worldwide, overtaking the mature markets for the first time, whose current share stands at 66.3 percent.

BigTechs are opening their e-wallets: Disruption of the payments market is accelerating as new technologies take hold and BigTechs and FinTechs make their presence felt. In particular, e-wallets are on the rise and present a major market opportunity for non-traditional payments providers. In 2016, e-wallets accounted for 8.6 percent of non-cash transactions (a volume of 41.8 billion), of which 71 percent were facilitated by BigTech providers.

Innovation faces complexities: Although disruption is accelerating, and market entrants are proliferating, there are regulatory and technical complexity challenges to the development of innovative new payments ecosystems, along with the expectation of the current level of security. Only 38 percent of bank executives surveyed for the report said they were ‘planning an anchor role’ in new payments ecosystems.

“As demand for digital payments is strong, especially in developing markets, some banks may want to revisit their choice to not seek an anchor role in the new emerging payments ecosystem,” said Anirban Bose, CEO of Capgemini’s Financial Services and member of the Group Executive Board. “With their significant market share in the payments industry and implementation of new technologies, banks are in a unique position to shape the marketplace. They can also create new revenue streams through innovative, collaborative relationships with FinTechs and active participation by the broader financial services community.”