As per the terms, if Cisco backs out of the deal or if it’s blocked by regulators, Cisco will pay Splunk a termination fee of $1.48 billion, according to a regulatory filing. If Splunk walks away, it will pay a $1 billion breakup fee to Cisco.

Cisco is set to aquire Splunk at an approx equity value of $28 billion. Upon closer of the acquisition, Splunk President and CEO Gary Steele will join Cisco’s Executive Leadership Team reporting to Chair and CEO Chuck Robbins. The combination of these two established leaders in AI, security and observability will help make organizations more secure and resilient.

As per the industry pundits, this bid is the largest acqisition of Cisco after 2006 when it acquired Scientific Atlanta for $6.9 billion. As per news report, the purchase price of Splunk is equivalent to about 13% of Cisco’s market cap, which puts the company in a slight risk territory. Some of the pundits also opine that Cisco is losing market share due to the growth in cloud computing and Cisco is more heavy on on-premise solutions. It is reflecting from the fact that Cisco shares have underperformed in the Nasdaq this year, rising 12% while the tech-heavy index has jumped 27%. Over the past five years, it’s been an even worse investment related to the broader sector. The stock is up about 10% over that stretch, trailing the Nasdaq’s 66% gain.

Perhaps this reason led the management to consider focusing on investing more on the security business. Apart from acquiring Splunk, which is a leader in Application performance monitoring (APM) and Observability space, Cisco has acquied four Cyber security companies in 2023, i.e. Armorblox, a threat detection platform; Oort – an identity management company and Valtix and Lightspin – cloud security companies.

The biggest positive is that the merger makes the entity most powerful in the sector and sends clear signal to the competition that they need to do more to thrive in the sector. This only leads to the benefit of the customers.

“We’re excited to bring Cisco and Splunk together. Our combined capabilities will drive the next generation of AI-enabled security and observability. “From threat detection and response to threat prediction and prevention, we will help make organizations of all sizes more secure and resilient.”

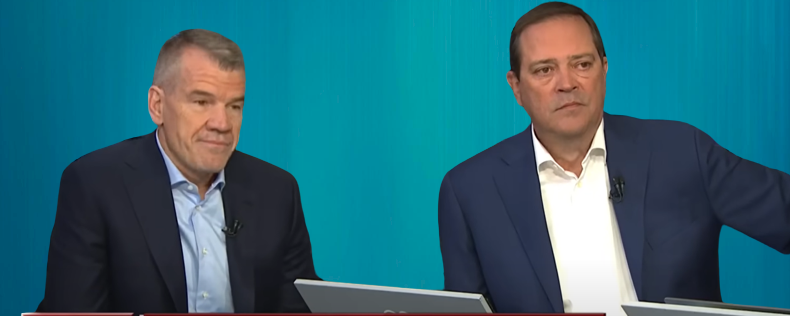

Chuck Robbins, chair and CEO of Cisco.

“Uniting with Cisco represents the next phase of Splunk’s growth journey, accelerating our mission to help organizations worldwide become more resilient, while delivering immediate and compelling value to our shareholders.”

Gary Steele, president and CEO of Splunk.

“Together, we will form a global security and observability leader that harnesses the power of data and AI to deliver excellent customer outcomes and transform the industry. We’re thrilled to join forces with a long-time and trusted partner that shares our passion for innovation and world-class customer experience, and we expect our community of Splunk employees will benefit from even greater opportunities as we bring together two respected and purpose-driven organizations,” Steele added.

Cisco and Splunk’s complementary capabilities will provide observability across hybrid and multi-cloud environments enabling the company’s customers to deliver smooth application experiences that power their digital businesses. Cisco and Splunk are well positioned to help customers responsibly harness the power of AI given their substantial scale, visibility into data, and foundation of trust.

Under the terms of the agreement, Cisco intends to acquire Splunk for $157 per share in cash, representing approximately $28 billion in equity value. The transaction is expected to be cash flow positive and gross margin accretive in the first fiscal year post close, and non-GAAP EPS accretive in year two. Additionally, it will accelerate Cisco’s revenue growth and gross margin expansion.

The acquisition has been unanimously approved by the boards of directors of both Cisco and Splunk. It is expected to close by the end of the third quarter of calendar year 2024, subject to regulatory approval and other customary closing conditions including approval by Splunk shareholders.

As per the terms, if Cisco backs out of the deal or if it’s blocked by regulators, Cisco will pay Splunk a termination fee of $1.48 billion, according to a regulatory filing. If Splunk walks away, it will pay a $1 billion breakup fee to Cisco.