CA Risk Analytics help reduce friction for consumers during online checkout

CA Technologies has introduced a new release of CA Risk Analytics which includes intelligent, self-learning authentication technologies that help reduce friction for consumers during online checkout and allow card issuers to reduce incidents of fraud, increase revenue and gain unprecedented flexibility and control in their fraud detection systems.

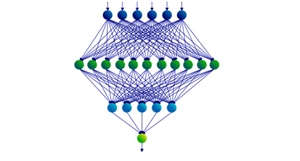

This latest version of CA Risk Analytics incorporates sophisticated, patent-pending behavioral neural network authentication models for assessing risk of online, card-not-present (CNP) transactions announced the press release.

The neural network models are powered by machine learning techniques that capture data about individual user actions and enable CA Risk Analytics to better understand and distinguish legitimate behavior from fraudulent behavior. Optimized for 3-D Secure protocol, CA Risk Analytics prevents CNP fraud in 3-D Secure transactions by transparently assessing the risk of a transaction in real-time.

“History shows that the continued global rollout of the EMV standard and the increasing distribution of Chip and PIN cards will result in an increase of CNP fraud attempts. This demands a more advanced CNP fraud detection strategy that goes beyond just comparing the current transaction to established fraud indicators,” said Vic Mankotia, vice president, solution strategy, Asia Pacific & Japan, CA Technologies. “CA Risk Analytics and its behavioral neural network models will result in “zero touch” authentication that will instill a level of confidence and streamline the online checkout process.”

CA Risk Analytics considers both fraud patterns and legitimate transaction behavior and tracks the pivotal players in a transaction: card or device, for example. It estimates the risk of fraud using advanced machine learning techniques to understand normal behavior for these pivotal players as well as the fraud risk related to deviation from past behaviors. This results in a more accurate assessment of which transaction to authenticate and helps stop fraud in CNP transactions.