Cushman & Wakefield, a global real estate services company, has released its Asia Pacific Data Centre H1 2024 Update. The report shows the Asia Pacific data centre market recorded 1.3GW of new supply in the first six months of the year, to reach a current operational capacity of 11.6GW.

Malaysia, predominantly Johor, saw the greatest increase in operational capacity, up 80% from H2 2023. The Head of Cushman & Wakefield’s Data Centre Advisory Team in Asia Pacific, Vivek Dahiya, said: “Malaysia’s recent growth is the result of a culmination of factors including spillover from Singapore, developer speed to market and the country’s ‘ready for service’ infrastructure. Cost is also a major factor. Malaysia’s central bank rate is competitive and this, combined with a relatively affordable cost of entry and government incentives for the sector, make it an appealing location for customers from hyperscalers through new entrants to the sector.”

Vivek Dahiya, Head of Cushman & Wakefield’s Data Centre Advisory Team: “Malaysia’s recent growth is the result of a culmination of factors including spillover from Singapore”

The influence of technological advancements such as the implementation of cloud computing, deployment of 5G networks, government digitization initiatives and increasing mobile and internet penetration, especially in fast growing populations, have significantly accelerated the demand for data centres globally.

In Asia Pacific, the largest six markets account for ~85% of operational capacity. Sydney is the fastest growing market in Asia Pacific by megawatt growth, adding 177MW in operational capacity in H1.

The development pipeline2 includes 4.2GW of under construction activity and 12.0GW in the planning stage. This represents an increase of 2.8GW in development activity since end-H2 2023.

Asia Pacific market dataFigure 1: Largest markets by operational capacity

| Rank | Geography | Capacity (MW) | Capacity (GW) |

| 1 | Chinese mainland | 4,199 | 4.20 |

| 2 | Japan | 1,423 | 1.40 |

| 3 | India | 1,406 | 1.40 |

| 4 | Australia | 1,230 | 1.20 |

| 5 | Singapore | 985 | 0.99 |

| 6 | South Korea | 649 | 0.65 |

| 7 | Hong Kong, China | 584 | 0.58 |

| 8 | Malaysia | 349 | 0.35 |

| 9 | Indonesia | 296 | 0.30 |

| 10 | Taiwan, China | 246 | 0.25 |

Figure 2: Largest markets by total market size

(including operational, under construction and planned)

| Rank | Geography | Capacity (MW) | Capacity (GW) |

| 1 | Chinese mainland | 6,515 | 6.52 |

| 2 | India | 4,336 | 4.34 |

| 3 | Japan | 4,059 | 4.06 |

| 4 | Australia | 3,278 | 3.28 |

| 5 | Malaysia | 3,108 | 3.11 |

| 6 | South Korea | 1,727 | 1.73 |

| 7 | Singapore | 1,334 | 1.33 |

| 8 | Hong Kong, China | 1,127 | 1.13 |

| 9 | Indonesia | 1,046 | 1.05 |

| 10 | Thailand | 467 | 0.47 |

Figure 3: Largest cities by total market size (including operational, under construction and planned)

| Rank | Geography | Capacity (MW) | Capacity (GW) |

| 1 | Beijing | 2,919 | 2.92 |

| 2 | Tokyo | 2,725 | 2.73 |

| 3 | Shanghai | 2,050 | 2.05 |

| 4 | Sydney | 1,993 | 1.99 |

| 5 | Mumbai | 1,831 | 1,83 |

| 6 | Singapore | 1,334 | 1.33 |

| 7 | Seoul | 1,231 | 1.23 |

| 8 | Hong Kong, China | 1,127 | 1.13 |

| 9 | Johor | 1,898 | 1.90 |

| 10 | Kuala Lumpur | 1,094 | 1.09 |

Market maturity index

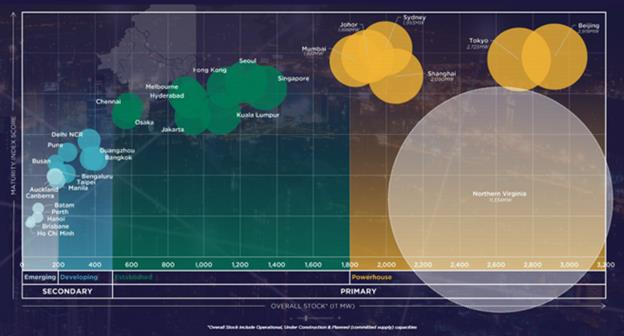

Figure 4: Market Maturity IndexCushman & Wakefield’s Asia Pacific Maturity Index tracks 30 data centre markets across Asia Pacific to assess both their current maturity and their future potential3.Powerhouse markets are Sydney, Johor, Beijing, Tokyo, Mumbai and Shanghai.

- Sydney is considered the most mature market in the region, based on a combination of variables including size, vacancy rate, operator presence and individual asset level build capacities. While Beijing and Tokyo have tighter vacancy levels, Sydney scores higher for its larger build capacity (scale of individual data centres), which is an indicator of future strength considering impending AI deployments.

- Johor ranks as the second most mature market, considering very low vacancy at 2% and with the highest build capacity amongst all markets.

Established markets are Seoul, Hong Kong China, Singapore, Melbourne, Hyderabad, Chennai, Kuala Lumpur, Osaka and Jakarta. These prominent markets have either exceeded 1.0GW size, or are approaching 1.0GW. Many of these markets benefit from strategic geographic locations and connectivity.

- These established markets are witnessing continued interest by the American hyperscale cloud entities, with all markets having presence or committed pipeline of at least one or two of the entities; Singapore has three.

Developing markets, Delhi, Pune, Guangzhou, Bangkok, Bengaluru, Taipei, Manila, typically have smaller live capacities. These markets typically have higher vacancies because the absorption rates are slower than the addition of new supply.Emerging markets cumulatively account for about 3% of the total operational capacity in APAC. The under-construction pipeline for these markets remains in the single digits as operators wait for further evidence of demand before converting planned capacity into operational.