MSMEs in Tier II and Tier III cities are at-par with their counterparts in metros in terms of revenue and growth, according to Instamojo.

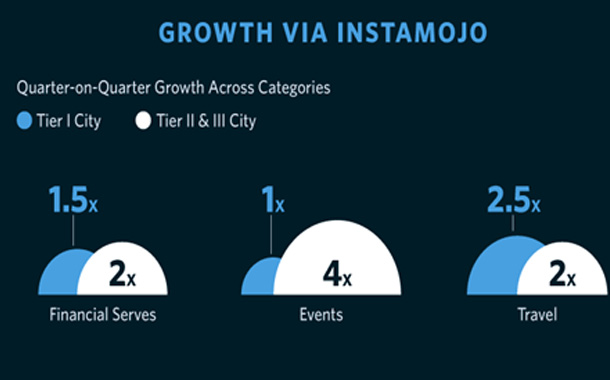

Over the past year, MSMEs in Tier I cities recorded a 1.15 x growth in their annual turnover, while small businesses from Tier II and Tier III markets were a close second with a 0.75x growth. However, in the last quarter, MSMEs from Tier II and Tier III markets from the events and financial services sector have witnessed a higher growth than Tier I cities.

“Indian MSMEs in Tier II markets have recognized the potential of the internet and how it can help their business grow. Businesses that have gone digital are now exposed to to consumers, manufacturers, exporters and suppliers across the country. Tier II and Tier III markets have the potential to emerge as SME hubs and we, at Instamojo are delighted to accelerate this growth through our solutions”, said Sampad Swain, CEO and Co-Founder, Instamojo.

Out of 52 MN SMEs in India, 96% businesses remain unregistered. Only 32% SMEs have gone online or accepted digital modes of business. Instamojo has acquired 10% of the digitally-active SMEs in India and enables 30% of their total annual sales. The company aims to extend its wallet share to 70% by 2019 and grow its merchant base to 1 MN in 2018.

The company turned EBITDA positive in July 2017 and has witnessed a 10-15% month-on-month growth. In addition to link-based payments, Instamojo plans to introduce e-commerce enabling services, cataloguing, compliance, lending, logistics, promotions via third-party providers going forward.