Manufacturing continues to dominate China spending on robotics, with discrete and process manufacturing leading the way

IDC Asia/Pacific reports that China spending on robotics and related services will more than double, growing from $24.6 billion in 2016 to $59.4 billion in 2020. Information on China robotics spending across 13 industries with 52 application areas is now available in IDC’s latest Worldwide Semiannual Commercial Robotics Spending Guide. This report now also includes data on commercial and consumer purchases of drones and after-market drone hardware in addition to spending data on robotic systems, system hardware, software, robotics-related services, and after-market robotics hardware.

“China continues to lead the growth of worldwide robotics adoption, primarily driven by strong spending growth in process manufacturing and cross-industry applications,” says Dr. Jing Bing Zhang, Research Director, Worldwide Robotics and Asia Pacific Manufacturing Insights, IDC Asia/Pacific. “In China, we are also seeing an accelerated growth in the adoption of commercial service robots especially for automated material handling in factories, warehouses and logistics facilities,” added Dr. Zhang.

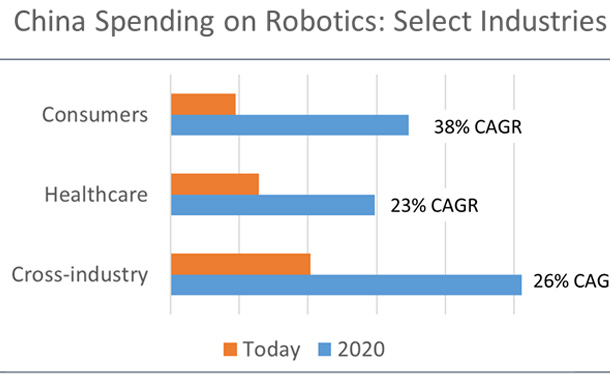

China is the single largest and the fastest growing robotics market in the world, and will account for more than 30% of the worldwide robotics spending in 2020. Manufacturing continues to dominate China spending in robotics, with discrete and process manufacturing accounting for over 50% of spending in 2016.

From a technology perspective, China spending on robotic systems, which includes industrial, service and consumer robots and after-market robotic hardware, is expected to hit $29 billion in 2020. Services-related spending, which encompasses application management, education and training, hardware deployment, system integration, and consulting, will grow to over $15.8 billion in 2020.

The Worldwide Commercial Robotics Spending Guide quantifies the robotics opportunity from a region, industry, use case, and technology perspective. Spending data is available for more than 52 use cases across 13 key industries in eight regions. Data is also available for a wide range of robotics hardware, software, and services categories. Unlike any other research in the industry, the detailed segmentation and timely, global data is designed to help suppliers targeting the market to identify market opportunities and execute an effective strategy.